How Private Equity is Settin’ Trends

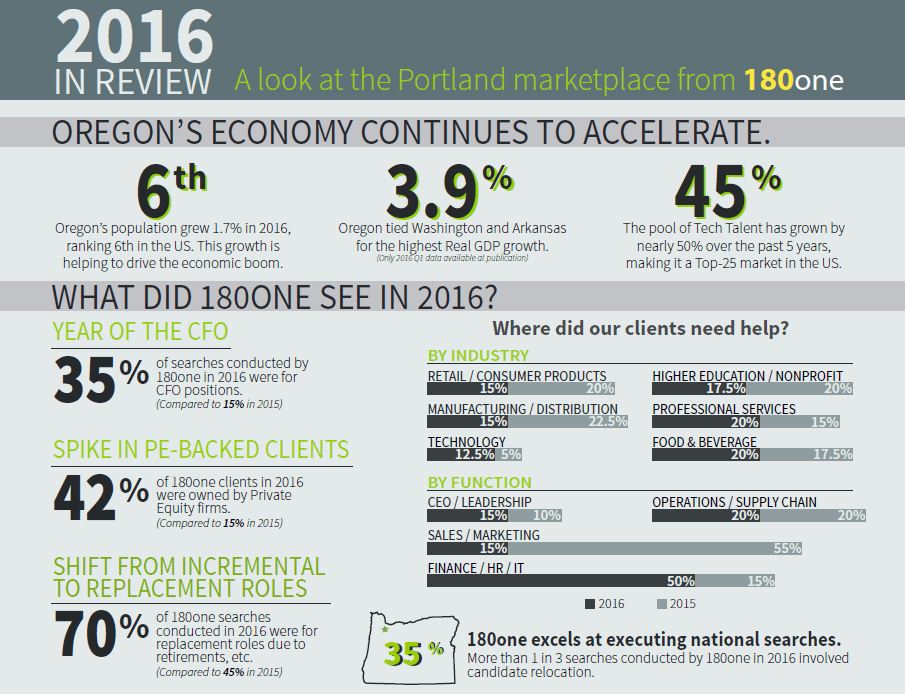

In previous years, when it came to patterns and trends in our business, it was safe to say that our clients’ needs were typically based on new strategies, new products, geographic expansion, etc. However, in 2016, we started to see a rather notable change. First, there was a clear shift from new roles to replacement roles—in fact, 70% of 180one searches conducted in 2016 were for replacement positions, compared to only 45% in 2015. Second, we saw a noticeable spike in the number of clients that were backed by private equity firms. In other words, we experienced a 180% increase in PE-backed clients from 2015 to 2016. And finally, with the help of these latest trends, 2016 became the year of the CFO for 180one as the percentage of our CFO searches went up from 15% to 35%, or a 133% increase.

One could conclude that the increase in PE-backed clients drove the increase of replacement roles, specifically with the CFO position. But how are these trends interrelated? Let’s take a look.

Private Equity vs. IPO

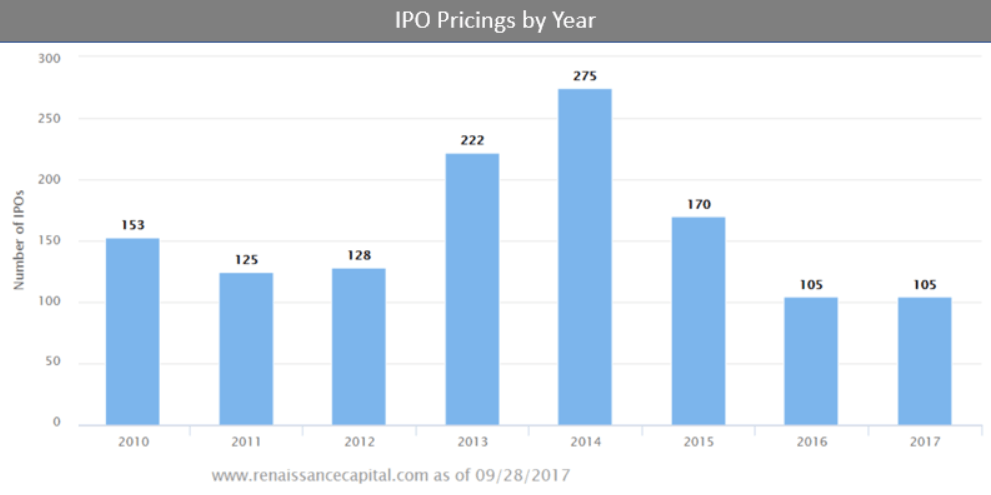

Why are more private companies choosing to take the private equity path? Why is private equity becoming so popular? According to an “Inc. 5000” article, getting to an IPO is still “the most prestigious rite of passage in American business”. But with the ever-changing market, access to capital, the compliance cost of going and staying public, and the desire to control its own destiny - new and growing companies are taking advantage of private equity.

According to a report from Renaissance Capital, 2017 is on track to be the second least active IPO year in the last eight years, just behind 2016 (with 105 IPOs priced). And while most companies look to an IPO to raise capital, Bain & Company’s Global Private Equity Report 2017 noted that more than $2.3 trillion of “new money” has been raised by private equity firms (from buyout to venture capital to growth to mezzanine funds) in the last four years, and more than half a trillion in each of these years. That’s a lot of capital that needs to be put to work.

So, while we have addressed some of the trends that are resulting in more companies choosing private equity as a means to additional capital, let’s see how this trend impacts the shift to replacement positions and the CFO role.

The Role of the CFO in Private Equity

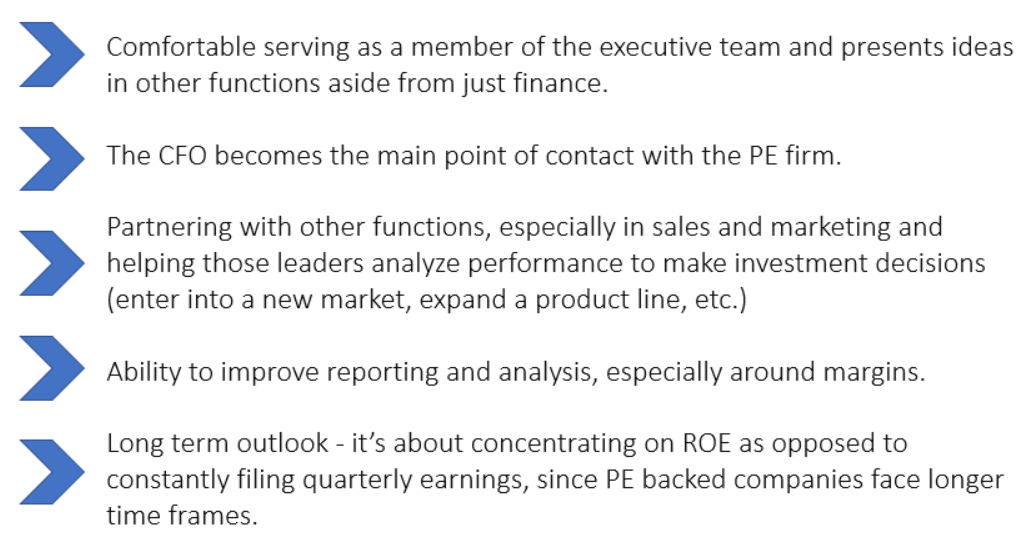

Since the great majority of private equity partners have strong financial acumen, PE firms place a great deal of focus on the financial performance of their portfolio companies, and the importance and breadth of the CFO has certainly evolved to address this dynamic.

Historically, the CFO was primarily responsible for ensuring accuracy in the financial statements, but, over time, CEOs are relying on their CFOs to provide the company with an “economic approach” to decision making. Answers to questions such as “should we build a new plant”, “should we expand a product line”, “should we acquire a target company”, are now being supported by the CFO’s organization.

In addition, private equity firms are interested in knowing and understanding how their portfolio companies are performing on a routine basis. While some companies they acquire already have a sophisticated level of financial reporting, most companies who are being acquired for the first time by a private equity firm have undeveloped systems to drive effective financial reporting. Based on this, a CFO who has the experience in building out a financial reporting process/system and knowing what areas the private equity firm will focus on provides a level of confidence that supports future investments and decisions.

Here are some of the common themes and traits we have found that make for a successful PE CFO:

The role of private equity CFOs has evolved beyond traditional accounting functions, and their sphere of influence is expanding fast.

Recruiting in the PE World

As executive recruiters, we understand the unique nature of conducting a private equity search. The similarities between a standard CFO search and a search for a PE CFO are fairly straightforward: the need for top talent does not waiver, there is still an importance riding on culture fit within the company, and of course the right technical skills are imperative. The differences, however, are a little more nuanced. With private equity firms involved, an additional party is introduced into the hiring process, and with that comes new expectations of what the CFO position must entail, as well as a change in how the search for an executive will unfold, which will ultimately vary from company to company.

There are cases in which the portfolio companies drive and manage the entire hiring process, while there are also situations where the PE firm offers guidance. It is a best practice to have the PE firm involved in the earlier stages of the process because the CFO position is a key link back to the PE firm on the performance of the company. Additionally, if the PE firm is not involved early on, there are no checks and balances of the hiring efforts, and thus it could be easy for the portfolio company to get started down a path that is not compatible with the vision of the PE firm.

PE firms play a vital role in the selection of a CFO, especially because hiring a CFO can be very stressful and it is not uncommon for a portfolio CEO to seek assistance in the process. Not everyone understands finance, especially in the context of private equity, so oftentimes portfolio companies end up needing guidance on how to assess the technical merits of a candidate.

Being knowledgeable about the expectations of the CFO by PE firms, as well as understanding how to include all stakeholders in the hiring process, leads to finding a more successful CFO who will not only accomplish what needs to be done in the short term, but will be able to keep up with the company as it grows. By using a search partner that truly understands the role and the nuances, private equity firms can avoid needing to conduct CFO searches multiple times.

180one Portfolio Companies

We’ve been proud to partner with the following companies that are backed by Private Equity firms: