How to Deal with the Dreaded Counteroffer

Previously on The Water Cooler, we explored ways to ensure that you come out on the winning end when making an offer to a candidate. But what happens when your top candidate receives a counteroffer from his or her current employer?

Counteroffers should be expected for exceptional candidates; as the market for top talent continues to tighten, companies are more willing to provide more incentives in order to retain their star employees.

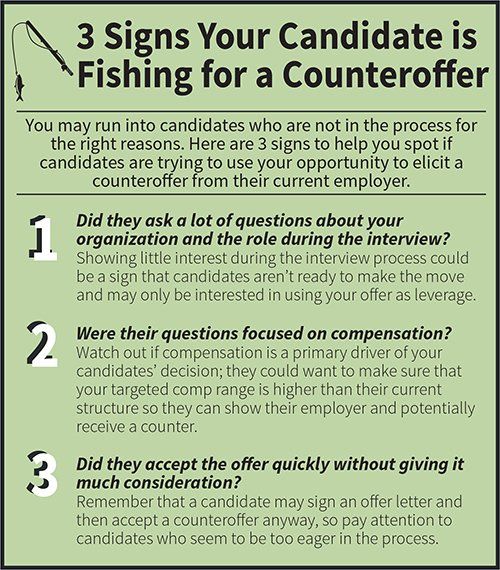

The best defense against a counteroffer, though, is a solid offense. Today we take a look at the ways you can mitigate the risk of a candidate’s counteroffer acceptance. We’ll highlight a few signs that candidates aren’t in the process for the right reasons, provide tips to help them give notice and much more to allow you to put up the best offense possible and lessen the likelihood of an accepted counteroffer.

The Interview Stage: Be the company they can’t “break up” with.

Building a strong relationship between the candidate and your company is the first place to start if you want to avoid a counteroffer down the road.

Candidates sometimes accept counteroffers because it’s more difficult to “break up” with their current employer than say yes to a new one. By cultivating a relationship between candidates and your organization early, you begin to sway the relationship meter so that accepting a counteroffer means they will have to “break up” with you, too.

The interview process is a critical time to truly get to know why your opportunity is the right one for your candidate. Structure interview questions to gain a better understanding of what a candidate’s current organization is not able to offer (outside of more compensation). Is your candidate looking for a management opportunity? Is the current organization a far commute? Does your company offer a stronger culture fit?

Asking these and other questions can help you determine what your candidate is interested in. If you know what candidates are looking for, you know the reasons why your opportunity is the right one for them and can reinforce these during the offer stage.

For candidates who need to give a long notice period to current employers, make sure you continue to cultivate the relationship prior to their official start date. Encourage their new team to take them out to lunch, and invite new hires to social activities at the office so they can become ingrained in your company culture early on.

The Offer Stage: Walk them through the process of giving notice.

When extending an offer to your candidate, always make it personal; rather than focusing on compensation, remind candidates about everything that your organization is able to provide that their current employer can’t.

Timing also plays a big role in whether your candidate will accept a counteroffer. Deliver your offer on Friday and set a deadline to accept. Eliminating business days between when you give your offer and when you reconnect with your candidate hinders the current employer’s ability to give a counteroffer. Ultimately, you want to make sure you have the last word, not the current employer, so schedule a time to follow-up with your candidate on Monday and cut down on the risk that you won’t hear back.

Many candidates are not experienced at giving notice, so you should also help them visualize the process by actually walking them through it. Ask what they think will happen when they give notice and if they expect to receive a counteroffer.

Surveys have shown that as many as 90% of professionals who accept a counteroffer end up leaving their employer within 18 months, so candidates may need to ask some hard questions about their current situation. Why is a current employer offering a raise or promotion now? Is the candidate only valuable when he wants to leave the organization for another opportunity?

Working with a search firm like 180one can be key at this stage, as a recruiting firm should be equipped to help candidates evaluate counteroffers and guide them through the tough questions that need to be answered before accepting.

Your candidate accepted a counteroffer. Now what?

Despite your best efforts, your candidate may unfortunately decide to accept a counteroffer. In that case, find out more about the decision to accept. Did the current employer offer more money? Did the counteroffer come with a senior title?

Make sure to be consultative, not defensive; you may ultimately lose the battle, but there is still a chance that you can change the candidate’s mind.

Extending offers on Fridays also helps maintain momentum in the process, as you can keep other candidates in your pipeline warm and potentially move onto your next top candidate if you need to.

While you can never eliminate the probability that a candidate receives or even accepts a counteroffer, you can mitigate the risk by having a great offense.

The interview process is an opportunity to build a relationship with candidates and ensure them that a move is the right next step in their career. In the end, keep a positive attitude. The stats show that candidates will likely leave their employers shortly after accepting a counteroffer anyway. Treat your top candidates well regardless of whether they accepted your offer; you could still come out on the winning end and hire them once they do decide to leave.

Want more insight? Check out our General Education section of The Water Cooler and explore topics ranging from candidate relocation to diversity & inclusion in the workplace and more.