Succession: Planning Tips (not from the HBO series)

Succession Planning is important but not the Plan

Succession planning is one of the most important challenges organizations face but can be the least straightforward on how to effectively plan for it based on constantly moving targets. There is a plethora of different scenarios that impact how a company plans for succession. Some common examples include promotions of high performers to varying levels, identification of leaders who are approaching retirement, or even advance preparation for replacing key executives due to outside circumstances. Or maybe a colleague decided to start their own company, and the natural successor is going with them? Suddenly, instead of a year to think through a transition, you have a fraction of that time. Each situation has its own nuances and requires a specific approach for a successful and smooth transition.

Key Factors in Succession Planning

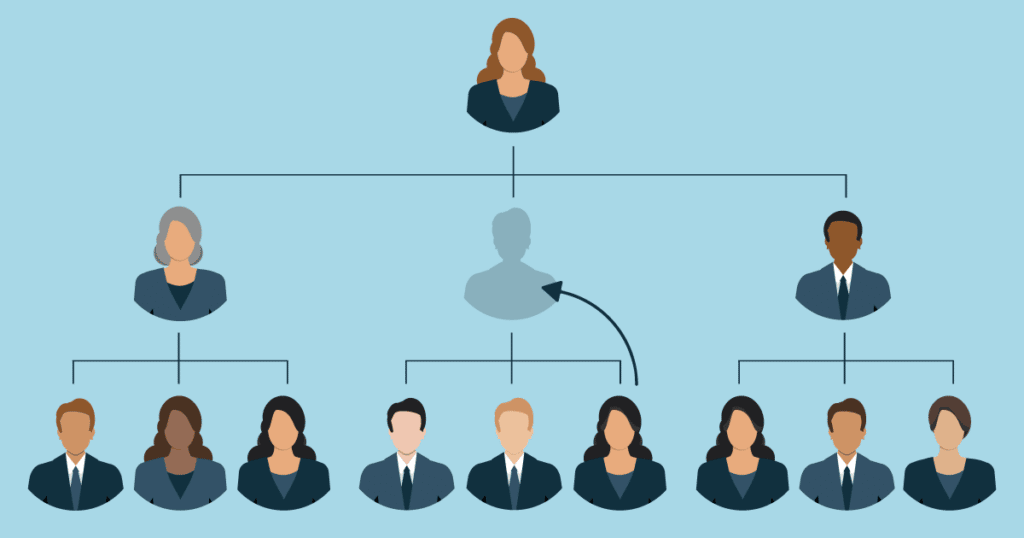

Succession planning requires, well, a lot of planning. While some believe only CEOs and Board Members need to prepare for succession, most organizations require managers to identify and develop team members as future leaders for a smooth transition. What we all know about succession planning is that it is fluid and will constantly change. With this understanding, rather than trying to solve all the details of a succession plan, consider adopting two main practices as you go through the initial planning process and future updates to the plan.

- Understand Your Timeline: This phase represents a crucial aspect of the succession planning process, as it addresses a key question: when will an individual be deemed prepared or invited to advance within the organizational hierarchy? Furthermore, it necessitates consideration of the broader ramifications resulting from the promotion's cascading effect on other individuals and functional areas. In such instances, the implementation of strategies becomes indispensable to effectively navigate both predictable and unpredictable timelines.

- Embrace Flexibility: As we all know, change is the only constant in business and life. It's often evident that as people continue to grow and develop, their roles and responsibilities evolve over time as well. As a result, replacing tenured individuals can prove to be an incredibly challenging endeavor. It’s imperative to contemplate redefining certain roles and exploring short-term compensation solutions. Embracing flexibility both within the organizational chart and the scope of responsibilities can set you up for an effective leadership transition.

Once you have a comprehensive understanding of your designated timeline and have meticulously analyzed the areas of the role that possess potential adaptability, you are now ready to develop your strategy for succession.

Identifying and Developing Succession Candidates

The timeline sets the structure of a successful leadership transition strategy. The three timeframes are short-term (between 6-12 months), mid-range (1-2 years), and an unknown timeline. Depending on the scenario you are dealing with, your prospective candidate pool and the skillsets you require for eligibility will vary.

Identifying and Developing Succession Candidates

The timeline sets the structure of a successful leadership transition strategy. The three timeframes are short-term (between 6-12 months), mid-range (1-2 years), and an unknown timeline. Depending on the scenario you are dealing with, your prospective candidate pool and the skillsets you require for eligibility will vary.

Short-Term Succession Timeline

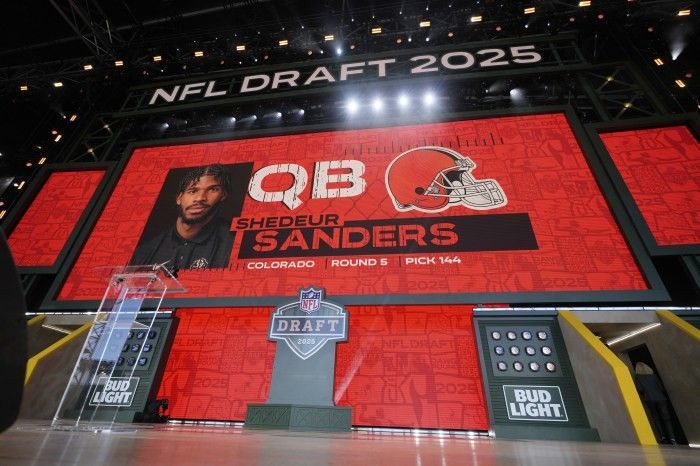

Picture this: You're a director at a mid-size company, and the CEO just gave you the great news that you've been identified as a successor for a VP role in another area of the business. The catch: you are responsible for your replacement, but your transition into the VP role won’t occur for another 9 months.

To address this situation, companies often adopt a flexible approach toward title and compensation in the short term to ensure the acquisition of a suitable successor.

Back to the example - If there’s no obvious internal successor, you’ll probably need to conduct an external search where the candidate would be ready for the Director from Day 1, despite having nine months left in the seat. If you hire a Manager under your Director title, there’s a risk they might not be prepared for the Director role in the given time-period or view the move as purely lateral. However, you don’t have the budget to bring on another Director level compensation to your team and anything less will probably not be sufficient to attract a candidate from a similar position. To fill the position for today (and more importantly for succession), the following measures can be implemented:

- Be open about the promotion timeline during the recruitment process so lateral hires understand the true hiring goal.

- On their first day, consider reallocating a portion of the organizational chart to them to avoid underutilization. Additionally, assign them important projects as individual contributors that you have been unable to complete due to time constraints. Create a business case to bring the candidate over with a Director title, along with the commensurate compensation level. Even though you may not have initially planned the budget for this, the incremental compensation would only be for a short-term period and would help you place a high-caliber leader in the position immediately.

Mid-Range Succession Timeline

Okay, so you have some time to plan.

Within a timeline ranging from 1 to 2 years, you can strategize for upcoming successions in a more gradual and organic manner. During this timeframe, it’s crucial to allocate sufficient time for introspection and delve into thoughtful contemplation about your existing team. By asking probing questions, you can effectively identify key contributors who possess the potential to become ideal successors. Some questions you can ask include: How is the team performing under the current leadership? Where do they excel? Where is there room for improvement? Who takes the initiative to solve problems, and who asks insightful questions? When considering an ideal successor, what qualities or key attributes should they possess?

There are certain specific characteristics to seek in individuals when assessing your team for potential leadership roles. As stated in a Harvard Business Review article focusing on leadership development, the presence of four essential qualities—curiosity, insight, engagement, and determination—indicates the potential for leadership. Individuals exhibiting these traits can be nurtured for senior positions through suitable coaching and support.

To ensure effective succession planning during recruitment:

- Avoid over-committing in the recruiting process. While discussing potential succession can be appealing to candidates, refrain from making promises or hiring individuals who may feel discontented if they are not promoted soon after joining if an opportunity arises.

- Clearly communicate the timeline to prevent overselling future opportunities.

- Ensure you hire candidates at an appropriate level that aligns with their potential for upper leadership roles.

- Manage the corporate hierarchy carefully. Hiring multiple directors reporting to the same person can create competition and potential discontent. Instead, hire individuals at various levels, with differing role scopes and salary grades, to prevent bottlenecks and foster a broader talent pool.

The Mystery Timeline

Consider this scenario: your company’s CFO is probably going to retire in the next few years, but it has never been announced. As of right now, there isn’t an obvious internal successor for the CFO position. How do you recruit an external candidate to join your company with succession as a main objective when you can’t commit to a timeline for them?

There are several challenges in this situation. You need a candidate who is ready now for the CFO role (the retirement announcement could be any day!). You are likely asking them to take a temporary demotion in title or leave their current organization where the timing of their next promotion could be well known. Why would a candidate be interested?

A better question to ask: How do you find the candidates who will be interested? Look for CFOs who are coming from:

- A smaller or less complex organization than yours, but they are ready for the next level of challenge.

- A larger organization where there is a bottleneck for moving to the next level and your organization provides a clearer path to promotion.

In some cases, the wise move might be to act on the succession plan sooner rather than later. Rather than having the incumbent retire from the company ahead of their own timeline, have them take on another role that is valuable to the company but provides you the opportunity to promote a quality team member internally. This solution retains your talent pipeline, shows your organization that you want to hire from within, and provides a smoother transition because the outgoing CFO is still in the company to provide guidance based on expertise and institutional knowledge.

Flexibility Is the Key

Whether it’s flexibility with your timeline, the willingness to remain open-minded about the org chart, scope of responsibility, or compensation, the ability to pivot quickly when succession is at stake is an asset. For example, if your company has a “unicorn” CFO (they have taken on additional responsibility that is unique to their interests and skillsets but wouldn’t normally be found in another CFO candidate), it may be extremely difficult to find someone who has direct experience fulfilling all the roles your tenured executive does. Adjusting the scope of responsibilities for the new CFO to be closer to the typical functional role is a great way to increase your flexibility and help speed up your hiring process for succession.

Instead of expending valuable time and resources trying to find another needle in the haystack executive, focus on hiring someone who can do 80% of the responsibilities and spread the other 20% to people already in place who have the proper skillsets.

Succession planning is a complex topic without a strict roadmap. However, it should be a consideration whenever you recruit and hire for your company. Each new manager, director, or executive should be evaluated as a potential candidate for upward mobility within your organization. Having individuals on the team with the potential for advancement is advantageous for everyone. They can learn directly from senior leadership and potentially take over their roles in the future. This ensures that if a sudden need for succession arises, there are already knowledgeable individuals in the pipeline. Proactive planning can help you avoid the consequences of a last-minute hire or promotion that proves to be unsuccessful. Even if you have six months to work toward a succession transition instead of a year or two, embracing flexibility and knowing what to look for will ultimately set you up for success as you look to find a new leader.